Products

Fast, Reliable, Everywhere

Solutions

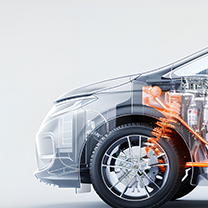

Efficient, Innovative EV Charging Solutions.

The EV charging industry is entering a pivotal moment. With profitability in sight, network operators face new and evolving challenges that will determine their success in the years ahead. The 2025 State of EV Charging Network Operators Report offers a deep dive into these issues, revealing where operators stand in scalability, network stability, and customer experience.

Survey findings highlight that while profitability is within reach, operational hurdles remain significant.

Biggest Challenges:

Maintaining high charger utilization and ensuring network stability are critical for profitability, yet they rank only as the second and third most pressing issues.

Network Scalability:

Platform Scalability:

To improve driver satisfaction and operational efficiency in 2025, operators are prioritizing:

These investments aim to enhance service quality, increase network reliability, and create competitive advantages.

The findings are based on a survey conducted in January 2025 by Global Surveyz, involving:

sino is a global leader in EV charging and energy management software, with:

| Category | Key Data |

|---|---|

| Top Challenge | Energy availability at sites (46%) |

| Charger Utilization | 39% see it as a major challenge |

| Network Reliability | 37% consider it a significant issue |

| Highly Scalable Networks | Only 18% |

| Platform Scalability | 45%–61% minimally/moderately scalable |

| Top Investment Priority | Optimizing operations (33%) |

Final Word

The 2025 State of EV Charging Network Operators Report makes one thing clear: success in this industry depends on solving grid availability issues, scaling networks intelligently, and optimizing platforms for efficiency. Operators that address these areas will be better positioned to meet surging EV demand while ensuring a superior driver experience.