Products

Fast, Reliable, Everywhere

Solutions

Efficient, Innovative EV Charging Solutions.

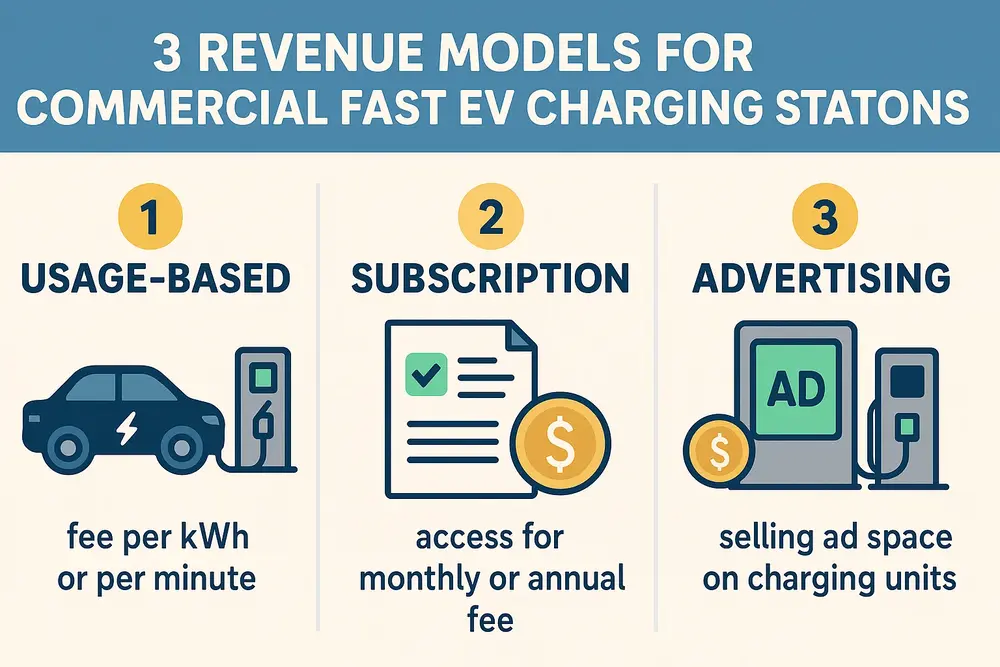

With the growing demand for electric vehicles (EVs), DC fast-charging infrastructure is expanding rapidly. While the upfront costs are high, businesses can realize long-term profitability by diversifying revenue streams. Here are three core models to generate income from commercial EV charging.

Direct charging fees represent the most straightforward revenue stream. These are fees collected from drivers for using the charging service. Operators can employ various pricing models:

These models allow flexibility in tailoring pricing strategies to attract and retain users, while also managing station utilization.

Additional Sub-Revenue Options:

Collaborating with property owners, local governments, and commercial venues can significantly reduce upfront infrastructure costs and open new income avenues:

Such alliances also elevate brand credibility and broaden your customer base.

DC fast charging takes longer than ICE refueling, giving drivers time to shop, eat, or use services nearby. This waiting time presents an opportunity to boost spending:

Whether charging customers for the service or offering it as a complimentary feature to boost foot traffic, this model emphasizes the multiplier effect of customer presence.

The global EV charging infrastructure market is expected to reach $150.2 billion by 2030, with DC fast charging contributing over 70% of that value. Although the average investment per DC charger ranges from €50,000 to €100,000, the potential ROI can be substantial, especially when layered with diversified income streams.

Example revenue scenarios:

| Scenario | Chargers | Utilization | Monthly Revenue (est.) |

|---|---|---|---|

| Café stop (low) | 1 | 4 sessions/day | $4,200 |

| Restaurant (mid) | 2 | 2 sessions/charger/day | $1,680 |

| Highway hub (high) | 8 | 16 sessions/charger/day | $19,920 |

Investing in DC fast-charging infrastructure is not just about selling electricity—it's about building a robust ecosystem. Combining session fees, strategic collaborations, and increased on-site spending creates a comprehensive revenue model. With smart planning and location selection, businesses can capitalize on the EV transition and establish profitable, future-ready charging hubs.